How to Avoid Penalties for Misclassifying 1099 Contractors

While using 1099 workers—also known as contractors—can lower costs, your home remodeling business could face steep fines. An Illinois home improvement company paid $328,500 in penalty fees after the state ruled

18 of its workers qualified as full-time employees.

To safeguard your business, create a brick wall of protection that confirms the legal status of your contractor workers. Here are 8 essential bricks you need in your wall.

The 8 Essential Bricks of Protection

1.) Have a Written Agreement

Create a contract that explicitly defines the independent contractor relationship.

2.) Confirm Their Business has an EIN

Employer Identification Numbers are:

- Registered with the IRS

- Their business’s tax identification number

- Note their personal social security number

3.) Hire Contractors as Independent Business Entities

IBE designations include:

- LLC

- Sole Proprietor

- Partnerships

- Corporation

4.) Ask for Their Professional Licensing

Licensing confirms the contractor is an IBE and not your employee.

5.) Pay 1099 Workers Per Job

Log each job they complete separately in your payroll to reaffirm their pay-per-job status.

6.) Prove They Work for Others

Contractors have a business website or advertise their services, even if they primarily work for you.

7.) Issue Contractors an IRS 1099 MISC Form

You must file and issue a 1099 MISC form to most independent business entities. Visit IRS.gov to confirm requirements.

8.) Confirm They Have Business Tax Returns

Filing taxes as an IBE affirms their contractor status.

Watch D.S. Berenson Speak

Below are must-watch highlights from the Prevail Webinar Series.

Building a Brick Wall of

Protection Around Your Business

D.S. Berenson pinpoints subcontractors as a significant threat to home improvement companies. The legal gray area around their employment status can trigger sprawling litigation —even class-action lawsuits— against your business. In this clip, Berenson outlines the critical steps you must take to build a legal brick wall of protection around your company.

The Critical Bricks in Your Wall:

- Written Agreement

- Hiring IBEs

- Filing Under EIN

- Pay-Per-Job

- Work For Others

- IRS 1099 MISC

- Tax Returns

Legal Advice Every

Contractor Should Know

D.S. Berenson is one of the top attorneys specializing in home improvement law. He’s served as general and special counsel to contractors, remodeling industry manufacturers, and trade associations. In this video, Berenson draws on his years of legal expertise to share his brick wall method to protect home improvement companies and other tactics to keep your business legally and financially secure.

Learn More About

Berenson Law LLP

“Our reputation within the remodeling and home improvement industry precedes us, and we strive to provide the highest level of specialized legal and consulting services available in the most effective and cost-efficient manner allowable. This is not a hollow motto; it is what our firm was founded on and it is what we practice by. We appreciate your allowing us the opportunity to represent your interests and we hope to assist you in the growth of your business in a prompt and professional manner.”

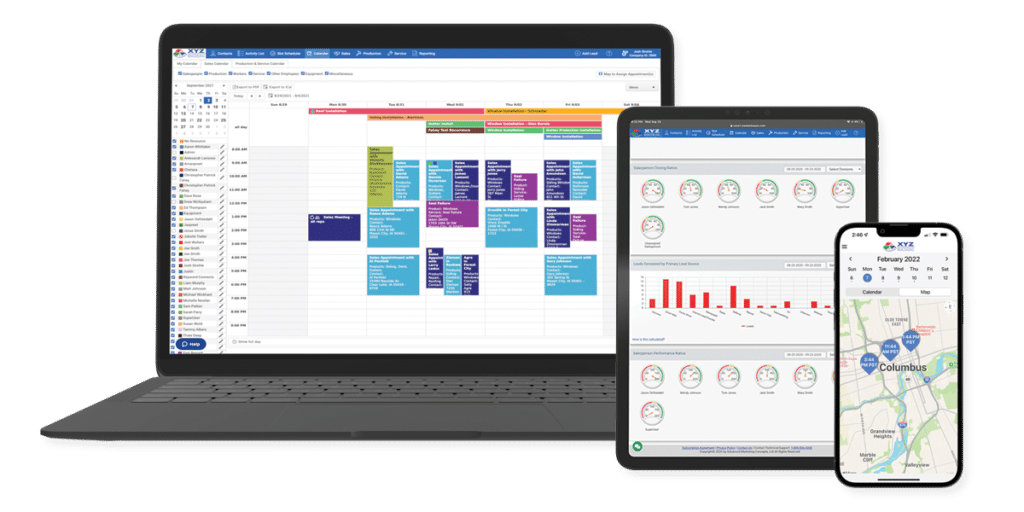

Learn More About MarketSharp

The all-in-one, software solution for home service professionals looking to automate their business with industry-specific workflows and end-to-end tools, with easy-to-use features and out-of-the-box value.