In the wake of the COVID-19 pandemic, the home improvement industry experienced a buying boom. Homeowners went on a spending spree, fueled by pent-up demand and historically low interest rates.

This red-hot consumer spending, coupled with supply-chain issues, a tightening labor market, and other economic pressure points, led to ballooning inflation. And, well, you know the rest.

The Federal Reserve has increased interest rates consistently in the first half of 2023 to tame inflation. Now, that dreaded word looms over the U.S. economy: Recession.

Will a recession happen in 2023? And how are remodelers and contractors adjusting to the slowing economy?

To answer these questions, we gathered home improvement data and feedback from working professionals to map home improvement industry trends in 2023.

How Did We Source Our Data?

MarketSharp has partnered with home improvement pros for 30 years. Our CRM software is currently used by over 10,500 home services professionals.

To understand the state of the industry, we surveyed 80+ remodeling and home improvement pros who use MarketSharp’s CRM platform. They provided real-world insights into year-over-year industry changes, customer demand, project financing, labor shortages, and much more.

Additionally, we compiled propriety data from our home improvement CRM software. To date, MarketSharp users have completed over 7 million home services jobs in our software. We harnessed this data to map 20+ years of home improvement trends.

This article will provide an overview of 5 home improvement industry trends in 2023. For each trend, we will outline tactics to capitalize on them.

Our goal is to give you the insights you need to ensure your business thrives regardless of economic uncertainty in 2023.

1. Decline in Demand Means Increased Competition

The demand for home improvement services decreased year-over-year from 2021 to 2022, and 2023 will likely see a further decrease in demand. This means more competition over fewer potential customers.

To stay competitive, you may need to lower prices, diversify your offered services, or enhance marketing efforts to stand out from competitors. Retention will also be critical to ensure you don’t lose ground in your local market.

What we’re hearing:

The decline in demand is the home improvement market coming back to earth after the pandemic supercharged home remodeling demand. “The [US Remodeler Index] confirms the post-pandemic remodeling boom has passed,” said Eric Finnigan, Vice President of Research and Demographics at John Burns Real Estate Consulting. “With home values now declining and interest rates soaring, look out for a more significant slowdown in residential remodeling next year.”

The Joint Center of Housing Studies agrees with this assessment of the home improvement industry trends. “Housing and remodeling markets are undoubtedly slowing from the exceptionally high and unsustainable growth rates that followed in the wake of the pandemic-induced recession.”

The JCHS also warns of additional hurdles the industry will face: “Spending for home improvements will continue to face headwinds from declining home sales, rising interest rates, and the increasing costs of contractor labor and building materials.”

What we’re seeing:

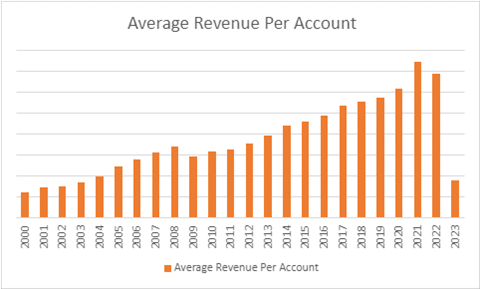

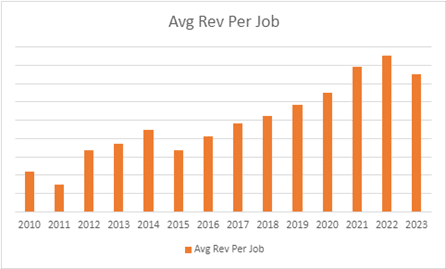

Based on data compiled in MarketSharp, our users saw an 8% decrease in average revenue in 2022. This was the first year of revenue decline since 2009, following the 2008 housing market collapse. This trend is likely to continue this year.

For 2023, we’re predicting a 15-to-18% drop in average revenue from 2022. This is based on the average revenue of our users over the first four months of 2023. With this decline, revenue levels in 2023 will likely settle slightly above the 2019 average.

The decline, in part, can be attributed to the market righting itself after the post-pandemic boom. 2021 saw an oversized increase in average revenue due to inflated demand. Our users experienced a 17% increase in revenue from 2020 to 2021.

Before the pandemic, our users gained, on average, a 7% annual revenue increase. A 17% jump highlights the 2021 post-pandemic boom that the home improvement industry experienced.

We would expect a return to 7% annual revenue growth in the future, barring another economic downturn.

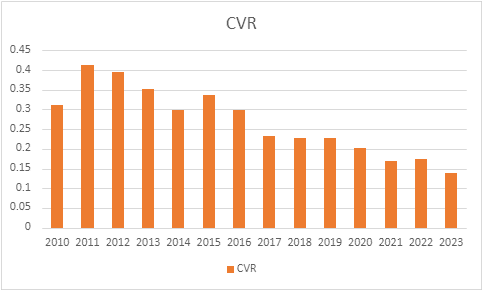

We are also seeing a decline in overall closed rates. However, this is not necessarily tied to the current economic landscape. There has been a consistent year-over-year decline in closed rates for the last decade.

In 2023, it takes nearly 2x the number of leads to achieve the same number of closed deals as in 2012. The contractors and remodelers we surveyed cited increased “tire-kicking” by customers. Homeowners are more willing to shop multiple businesses for their projects, leading to a dip in closed rates.

To combat this trend, our survey respondents said they’re working to improve marketing ROI. Some are even increasing their overall marketing budget in the coming year to land more jobs and “recession-proof” their businesses.

How you can act:

So, what can you do to combat lower average income and slower-to-buy homeowners?

Use the 6 Rs of Marketing:

- Radius marketing

Run neighborhood specials in neighborhoods where you’ve recently completed work. Get the word out through block walking and flyers.

- Re-engage latent leads

At the peak of demand, you likely were unable to work every lead coming into your business. Craft a marketing email to re-engage these latent leads to inquire about their home improvement needs. Facing long lead times, some homeowners may have put their home projects on pause until there was more availability.

- Repeat aka leverage your existing customer database

In your home improvement CRM software, you should have an expansive contact list of former customers. Reach back out to inquire about new home project needs. Even if you don’t land a job, you keep your business top of mind for your customers’ future projects.

- Referral marketing

When you re-engage your existing customers, ask them to provide referrals. Word-of-mouth marketing is one of the strongest ways to connect with new customers. You can incentivize referrals by offering discounts on future work or cash rewards.

- Revamp your speed to sale

Utilize your remodeling CRM software to deliver a faster and smoother sales process. This includes managing and tracking leads, scheduling appointments, sending follow-up communications, and providing accurate estimates promptly. By automating these tasks, you can shorten the sales cycle.

- Remarkable work

Deliver outstanding work that exceeds your customers’ expectations. You can leverage satisfied customers to generate positive reviews. Platforms like Listen360 help you manage and improve your online reputation. This is accomplished by building review requests into your project workflow.

2. Higher Interest Rates Decreased New Home Purchases

The US Federal Reserve has consistently increased interest rates throughout the first half of 2023 to fight soaring inflation. In turn, higher rates have cooled the housing market.

Adding to the slow market is low inventory. In part, this is due to so-called “golden handcuff” homes: houses purchased or refinanced during the pandemic. Homeowners are, in effect, trapped in these houses because their mortgage interest rates are historically low.

In fact, the U.S. saw its lowest rate ever during this time, falling to just 2.6% in January 2021.

The result is fewer Americans buying houses due to sky-high interest rates, and fewer people selling their “golden handcuff” homes, reducing housing inventory.

However, rental investors and cash buyers from higher-income states have continued purchasing houses, which has staved off a sharper decline in the market.

So, with fewer people moving and high interest reducing overall home loans, have remodeling projects completely dried up for the industry?

What we’re hearing:

Contractors continue to have full schedules in the current home improvement market. It’s their backlog of jobs that is shrinking in 2023. That’s according to Craig Webb, a consultant for building-supply firms. He told the Wall Street Journal, “Things are slowing down, but it’s not like we’re slamming the brakes.”

With the current challenges of the housing market, why hasn’t remodeling demand completely bottomed out? Liza Hausman, Vice President of Industry Marketing at Houzz, explains: “Faced with shortages of housing stock and high-interest rates, we’re seeing homeowners update their current home to make the space more functional for the long term.” That means, strangely, high-interest rates have both slowed remodeling but kept it going at the same time.

Here’s how: During the pandemic, interest rates dipped to all-time lows. Homeowners jumped on the opportunity and took out low-interest loans, borrowing against the value of their homes. They then put that money into renovating their homes, either to sell them for max value or to improve their living space.

Once interest rates spiked in 2022, fewer homeowners borrowed money to make renovations. Hence, the dip in remodeling demand. However, because the housing market is in decline, more people are staying in their current homes for the long term.

Those that can afford to pay out of pocket or take on high-interest loans are renovating to make their living space fit their long-term needs rather than moving.

What we’re seeing:

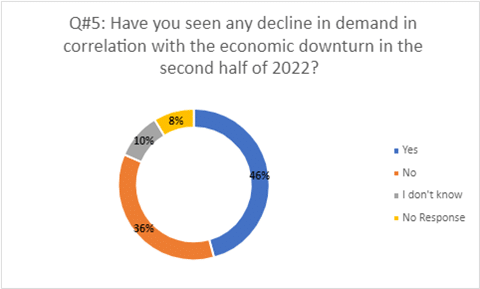

The home remodelers MarketSharp surveyed confirmed that the remodeling market is in flux but not in a full-scale decline. While 46% of respondents said they saw a decline in demand due in correlation with the economic downturn, 36% did not.

After the remodeling boom, the industry is only experiencing a slowdown despite a variety of economic pressures.

How you can act:

Many of the contractors and home remodelers we surveyed have previous experience with economic downturns. We asked those that weathered the 2008-2009 Great Recession for their advice for navigating a future recession.

They recommended focusing on lead generation and getting more creative with your lead sourcing. To maximize your lead sourcing, you need to reach both organic and non-organic leads.

Here’s the difference between the two lead types and ways to connect with them.

Organic Leads: Prospects who naturally discover your company through search engine results, word-of-mouth, social media, or other unpaid channels. They often come across your content or offerings while looking for information related to your industry or services, making them more likely to be interested in what you have to offer.

Organic leads are typically considered high-quality leads because they’ve shown an interest in your type of product or service on their own.

Ways to reach organic leads:

- Soliciting reviews on Google and Yelp from existing customers.

- Optimizing your website’s SEO so you appear high in local search engine queries for home improvement services.

- Managing business social media pages where you post industry-relevant content.

Non-Organic Leads: Prospects generated through paid advertising campaigns or other direct marketing efforts. This could include pay-per-click (PPC) advertising, display ads, sponsored social media posts, email marketing campaigns, and more.

While non-organic leads can be valuable, they may not always be as engaged or ready to purchase as organic leads. That’s because they didn’t necessarily seek out your company or offerings on their own.

Ways to reach non-organic leads:

- Run Google and Facebook ads.

- Partner with lead provider websites like EverConnect, Angi, and Porch.

- Purchasing contractor lead lists and cold emailing contacts.

The key difference between the two is that organic leads find your business naturally, while non-organic leads are driven to your business through paid efforts. Both types of leads are important for a well-rounded marketing strategy.

3. Homeowners Have Less Cash on Hand, More Reliance on Financing

While 82% of customers traditionally rely on their savings for home improvement projects, there’s a shifting trend toward exploring financing options. This shift is driven by the desire to maintain liquidity and spread the cost over time.

However, potential borrowers are showing reluctance toward traditional high-interest bank loans. They’re seeking more affordable, flexible financing solutions that won’t strain their budgets.

This presents an opportunity for home improvement businesses to offer competitive financing options and attract a broader range of clients.

What we’re hearing:

Houzz surveyed 24,667 U.S. homeowners about their 2022 renovations and plans for 2023.

They found that a quarter of homeowners relied on secured home loans—home equity or HELOCs—for projects of $50,000 or more in 2022. That’s a 2% increase from 2021.

The trend toward financing extends beyond remodeling construction. A 2021 C+R Research Survey of 2,005 online consumers found that Buy Now, Pay Later financing is used throughout home goods shopping.

Buy Now, Pay Later is a short-term financing option. At the point of sale, customers can split the purchase amount across several installments. They pay the first installment immediately and make further payments on the purchased item over time.

Buy Now, Pay Later is popular with customers because, unlike traditional loans, this option does not typically charge interest. For businesses, this strategy helps them land customers who may be priced out from paying the entire sticker price upfront.

What we’re seeing:

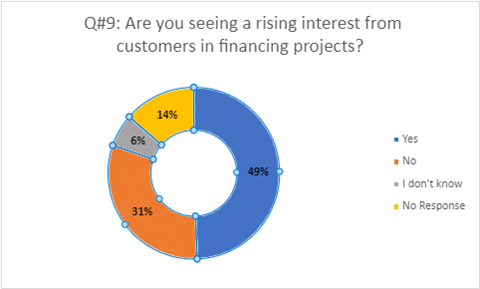

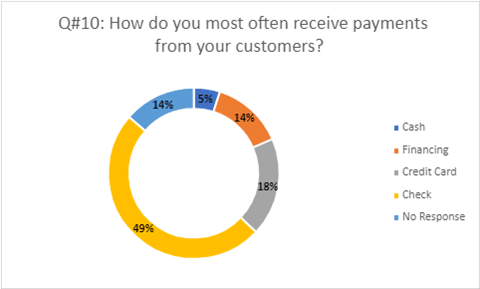

Roughly half of the professionals we surveyed reported increased interest from customers in financing home improvement projects.

While financing has made big strides in home improvement, only 14% of respondents said financing is the most common way they are paid by clients. Nearly 50% of respondents said homeowners pay by check most frequently, and 19% selected credit cards.

How you can act:

Capitalize on the growing demand for financing by adding it to your offerings.

Not sure where to start? The answer could be your remodeling CRM. Some software platforms partner with payment processors that offer financing options.

For example, MarketSharp Payments Powered by Stripe enables contractors to accept online and in-person payments via credit, debit, ACH. With this feature, MarketSharp users can offer financing through Stripe at no additional cost to their business.

If you have a remodeling CRM, review its integration. You may find your platform partners with a payment processor like Square, Stripe, or PayPal. By processing payments through your CRM, you can manage your full revenue cycle within a single software platform.

Once it’s added, create an email marketing campaign for your leads and former customers to promote your financing option. Low or no-interest financing breaks up the cost of larger projects, making your services attainable for homeowners originally priced out.

Write out talking points around financing. Your sales team can educate homeowners on this option during their sales process. You can also break down pricing on estimates to compare paying in full vs. financing the project.

In an industry slow to adopt new payment forms, offering financing can distinguish your remodeling and contractor business from the other guys.

4. Project Types are Shifting in 2023

When interest rates reached historic lows, homeowners were able to borrow against the equity of their homes. Subsequently, the remodeling industry trends skewed heavily toward large home remodeling jobs. But now that interest rates have skyrocketed, what home improvement projects will be most common in 2023?

What we’re hearing:

Large remodeling projects will feel the pinch in 2023, according to Eric Finnigan, Vice President of Research and Demographics at John Burns Real Estate Consulting. “It is the big-ticket jobs such as new kitchens and additions that tend to be done by professional remodelers and paid for by borrowing against the value of the house that are most at risk, he said.

Finnigan doesn’t predict a complete halt of large remodeling job, just a narrowing of the customers who can afford them.

“That segment of the market is really tied to how wealthy homeowners are feeling,” Finnigan said. “[Remodeling is] going to contract in a pretty big way this coming year, both in the number of projects and also the amount of dollars spent per project.”

While remodeling will slow, Finnigan predicts do-it-yourselfers won’t be deterred by rising rates. Though, they will be focused on smaller jobs, like painting a room or replacing a shower head.

The other projects that will continue in 2023 are those that can’t wait for lower interest rates. “Two-thirds of home improvement spend is nondiscretionary,” according to Lowe’s Chief Executive, Marvin Ellison. “If your refrigerator or water heater breaks, if your toilet stops working, or if your roof is leaking, these are projects or purchases that cannot be postponed.”

What we’re seeing:

From our survey, contractors have confirmed a slowdown in remodeling projects and non-necessity purchases. From this, the size of projects has decreased. Rather than expansive remodels, most homeowners are inquiring about small, quick projects.

One contractor pointed out how smaller projects offer less opportunity to upsell customers and increase revenue. Homeowners are less likely to add extra services to small projects.

Energy savings was also a common theme in the survey results. Homeowners have been willing to move forward with renovations that generate cost savings for the home.

Inquiries into government programs were commonly reported as well. In 2023, surveyed remodelers have seen an increased number of calls around energy-efficient windows subsidized by government programs.

Unsurprisingly, with jobs getting smaller, average revenue is projected to decline in 2023.

Data compiled from MarketSharp users shows that average revenue sharply rose in 2021 and 2022. In 2023, so far average revenue has dipped.

However, revenue is still higher than pre-pandemic averages. Outlier jobs—like large remodeling projects by wealthier customers—may explain why we aren’t seeing a larger decline.

Note: This data does not factor in job costs. It’s pure revenue per job. With higher interest rates, job costs are up. That means the net revenue per job will be smaller compared to 2019.

How you can act

If homeowners are shifting to smaller projects, your marketing strategy should shift, too.

What are the small projects your business specializes in? Identify two-to-three popular, small-scale services and build your marketing around them.

You can leverage your customer list and re-engage them with an email campaign. Digital ads on Google can expand your reach to catch homeowners searching for repairs and upgrades.

You can also leverage educational content around energy savings through home improvements. Facebook posts, paid ads, and emails can be used to inform local homeowners about how you can save them money with small-to-medium home upgrades.

Does your local or state government offer incentive programs around energy-efficient windows or doors? Create marketing to educate your customer base on the programs they can participate in.

Finally, leverage your strengths. What sets your business apart from your competitors? Brainstorm how you can emphasize this aspect of your business.

Don’t have a clear business differentiator? Research the latest tech in remodeling. Your business could be the first to offer the newest services in your area.

One emerging opportunity in remodeling is offering smart home technology. AARP reports that three-quarters of adults over 45 want to stay in their homes as long as possible. Known as “aging in place”, older adults are turning to tech like remote monitoring and smart HVAC, roofing, and windows to keep them safe while retaining their independence.

5. Labor Availability Has Improved

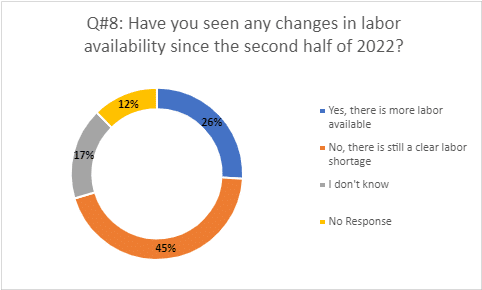

A surprising home improvement industry trend in 2023 is more labor availability. Though, it is only a small improvement.

While there won’t be an overnight fix for shortages, construction labor is on the rise. Even better, more young people are joining the skilled labor market.

What we’re hearing:

Construction employment increased by an average of 15,000 jobs per month in the first half of 2023. Though, this is below the 2022 average of 22,000 jobs per month.

The Bureau of Labor Statistics reports that construction added over 23,000 jobs in June, while over 10,000 residential specialty trade contractors joined the workforce in that time.

Trade school enrollments are up, while traditional college enrollment is dropping.

Many vocational programs saw double-digit increases based on National Student Clearinghouse Research Center data. Mechanic, repair, construction, and culinary courses all spiked in enrollment. Meanwhile, both two and four-year college enrollments sank in 2022. A 7.8% decrease for two-year programs and a 3.4% decline for four-year public universities.

These changes represent a shifting cultural view of vocational programs. More young people are forgoing the debt of college for trades with high starting pay.

While the numbers are encouraging, there is a long way to go to close the labor gap in construction. The Associate Builders and Contractors, a national construction trade association, is raising the alarm bells about the labor shortage.

“Despite sharp increases in interest rates over the past year, the shortage of construction workers will not disappear in the near future,” said Anirban Basu, Chief Economist for ABC. “First, while single-family home building activity has moderated, many contractors continue to experience substantial demand from a growing number of mega-projects associated with chip manufacturing plants, clean energy facilities and infrastructure.”

Basu says too few young workers are learning skilled trades—despite an increase in trade school enrollment—creating both a labor and skills shortage.

Additionally, the problem is compounded by an aging construction labor pool. “With nearly 1 in 4 construction workers older than 55, retirements will continue to whittle away at the construction workforce,” said Basu.

What we’re seeing:

44% of the home pros surveyed say there is still a clear labor shortage. However, a fourth of respondents have seen an improvement.

These responses reflect the national landscape. Labor is improving but very slowly. Trade school enrollments will need to continue to rise to replace an aging construction labor force.

How you can act:

The labor shortage won’t be resolved overnight. You have to take proactive steps to meet your staffing needs. Luckily, with trade school enrollment growing, you have more opportunities to connect with skilled workers.

The U.S. Chamber of Commerce recommends actively recruiting trade school students in five ways:

- Partner with trade schools so you get your brand in front of students early.

- Offer apprenticeships to develop and retain skilled workers.

- Connect with industrial networks like SkillsUSA.

- Attend trade school job fairs to conduct valuable face-to-face interactions.

- Offer competitive benefits like good pay, medical insurance, and work-life balance.

Retention is also critical. High turnover of qualified workers leads to sustained staffing shortages. Invest in your existing talent to hold onto them long-term.

Retention tactics include:

- Investing in their career development through paid training. Paying for all or part of training or certification programs can give you highly skilled workers who stay longer.

- Offering competitive benefits like medical and paid time off. You’re unlikely to hold on to talented workers if they can’t take care of themselves or their families.

- Pay them what they’re worth. Higher pay may cost more upfront but can save you from lower productivity through understaffed crews and inexperienced workers.

Key Takeaways:

There are signs that a true recession won’t materialize in 2023, regardless of numerous challenges. “This economy is incredibly resilient, despite all the slings and arrows—despite the banking crisis, rate hikes, the debt ceiling,” said Mark Zandi, Chief Economist at Moody’s Analytics, in a June 2023 interview with CNN.

Whether a recession happens or not, home remodelers and contractors are facing a slowing industry. By tracking home improvement industry trends in 2023, you can use their insights to protect your business proactively.

Here are the steps you can take:

- Improve your marketing & sales process to stay competitive.

- Recognize and capitalize on the trending projects homeowners are scheduling.

- Incorporate financing options to meet the growing customer interest.

- Reduce overhead to lower your business’s operating costs.

- Diversify your lead sourcing channels to maintain a healthy sales pipeline.

- Actively recruit trade school graduates to meet your labor needs.

A streamlined lead-to-project-completion workflow may be just what you need to thrive in a slower economy. Learn how MarketSharp can help!

Learn More About MarketSharp

The all-in-one, software solution for home service professionals looking to automate their business with industry-specific workflows and end-to-end tools, with easy-to-use features and out-of-the-box value.